Every veterinary business needs a secure way to collect payments that don't cost the earth. One that can offer your clients the latest payment methods, help your team easily carry out reconciliations, and give your business good cash flow. To help you understand the underlying costs behind every payment transaction, Windcave have put together a few things every business owner should be aware of when looking for a payment solution.

‘Integrated’ vs ‘Standalone’ payment terminals

Integrated

An integrated payment solution is when your EFTPOS terminal is synced up with your main Point of Sale (POS) business software system. When you integrate your payment system with your Point of Sale (POS) system, the invoice amount is gets sent directly from your business software to your client-facing payment terminal. In the case of ezyVet & Windcave, sales charges will flow directly from the financial tab straight through the Windcave payment terminal. Having two systems that 'talk' to one another minimizes human errors and gives you the ability to have real-time reconciliation and reporting.

Pros

- Minimalise chances of human errors and frustration

- Improved accuracy & reconciliation

- Improve cash flow and digital record keeping

- Time saved on payment handling for Front of House

- Quicker checkout and payment experience for your clients

- Ability to take payments online, meaning clients can pay you anytime, anywhere

Cons

- POS software may have an additional monthly cost

- Your terminal provider and POS will need to have a built-in integration

Standalone

A standalone payment solution is when your EFTPOS terminal is not required to connect to any other software. You will need to manually enter the amount of the sale prior to passing the terminal to your client.

Pros

- No third-party software is required

Cons

- Slower payment experience for staff and clients

- High chance of human error

- Manual transaction reconciliation

Which EFTPOS option is right for your business? 💳

Lease

EFTPOS terminal lease typically comes with a 36 month term and is a monthly charge. Some providers include the cost of support, upgrades and terminal replacements should any faults appear. You can choose to extend your contract at the end of your term.

Buy

EFTPOS providers will also have the option for you to purchase the terminal outright if you do not want to lease your terminal. You will pay an upfront cost for the device and providers generally will offer a monthly charge for support and software updates. Terminal replacements if any faults appear will be an additional charge.

Payment Schemes / Networks

Payment schemes or payment networks provide a way for transactions to be processed. This can be broken down into card schemes and debit schemes. Each scheme charges different rates per transaction which are reflected in your merchant service fees. Depending on your region, debit networks can charge a monthly fee and allow for unlimited transactions or charge a flat fee per transaction.

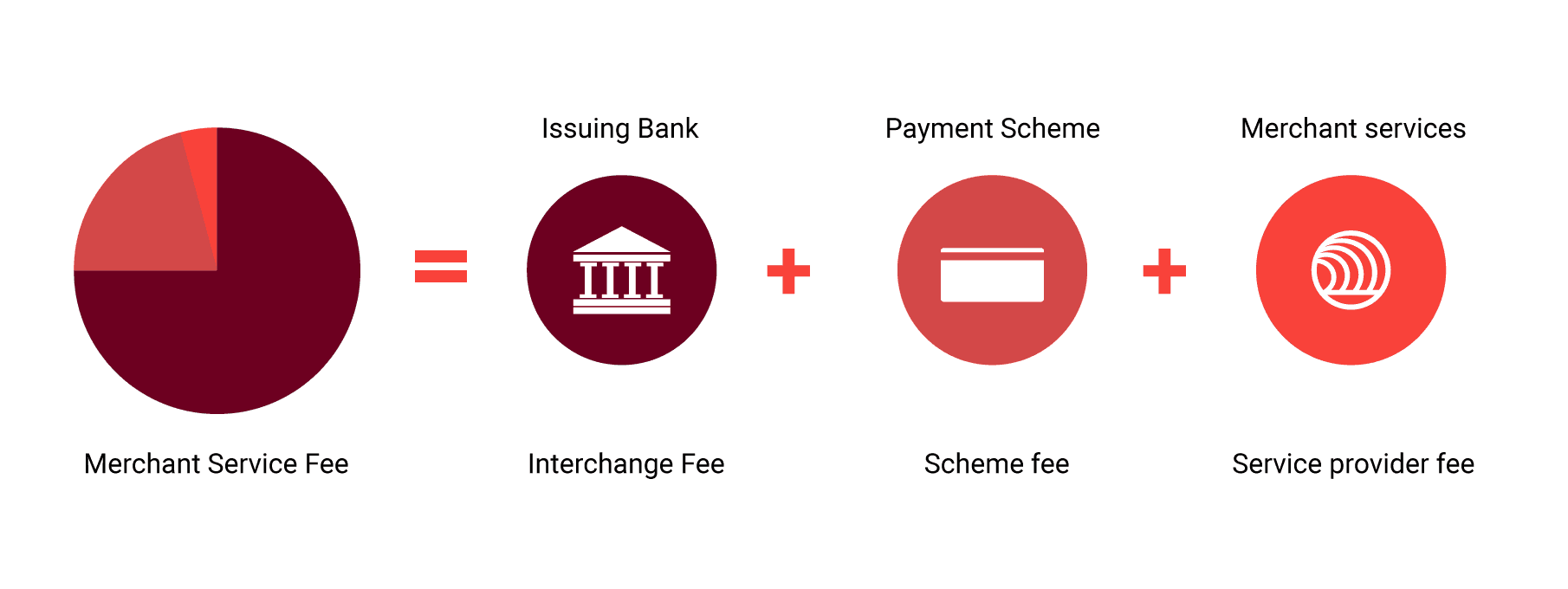

Merchant Service Fees

Merchant Services is a financial service that allows a business to accept cards and other forms of payments. All payment types will incur some form of a fee. Merchant service providers act as the intermediary between the banks and the person wanting to purchase goods or services. The merchant service fee (MSF) applies to all transactions and is typically calculated in a percentage for credit schemes and a flat rate for debit schemes.

Merchant Service Pricing Models 🏦

Blended

You will have one rate for each transaction regardless of the card scheme. This provides a simple pricing model with certainty for your merchant service fees at the end of the month.

Interchange+

Your rates will be split into two components. The interchange fees on the one hand and the service provider and card schemes on the other hand. This provides more transparency in the interchange fees.

Interchange++

Your rates will be split into three components, the interchange fees, card scheme fees and the service provider fees. This will the most transparent pricing model, but also the most complex in the different pricing models.

Contactless Payments: Tap & Go / Paywave / NFC

Accepting contactless payments means your customers will simply hold their card or phone to a contactless-enabled terminal to complete their transaction, processing the payment in seconds. These costs associated with accepting contactless payments could be a percentage of the transaction or a flat fee per transaction included in your merchant service fee.

Offering a mobile veterinary service? 📲🐴

Online Payment Gateway

A payment gateway is the equivalent of an EFTPOS terminal, but for accepting payments online. It securely captures a customer’s payment details and routes the information through a payment network. This is typically charged as fee per transaction with no option to lease or buy.

Online Merchant Services

Just like with payments through an EFTPOS terminal, online payments also incur a merchant service fee. Online transactions incur different merchant service fees to in-store payments. In most cases, accepting payment through an online application like a website or app will incur higher fees than processing the same card through an EFTPOS terminal.