Protect your practice from potential bad debtors

There’s no doubt that working in a vet practice can put you in a high-pressure environment. Finding the balance between day-to-day operations, providing quality patient care, and managing billing can be a constant struggle, and unfortunately, bad debtors come with the territory.

No one wants to chase clients up for payment as it's a stressful job and a waste of precious time trawling through client accounts, but it doesn’t have to be this way. Did you know that ezyVet has a handy feature that triggers an alert to help keep your team a step ahead of unpaid balances?

To make sure you're getting the most out of ezyVet, we share how you can create Custom Credit Limits to help protect your practice's financials from potential bad debtors.

What is a Credit Limit? 💳

Credit Limits allow you to control how much credit/unpaid balance a client can have on their account, without any manual intervention needed.

Before you get started it’s important to think about what types of Credit Limits would work best for your practice, for GP practices, the biggest risk to the business is new clients, due to not knowing their financial history. Creating a specific Credit Limit Status that allows a smaller amount of maximum credit available for new clients until they have a proven financial history, is just one way you can utilize ezyVet to monitor debt levels

How do Credit Limits work? 💸

Simply create a Credit Limit status, apply the status to the client's contact record, and then ezyVet will do the hard work for you. If a client reaches the maximum Credit Limit you have configured, the system will automatically apply for a stop credit. This means when a client with an unpaid balance reaching the maximum threshold tries to book an appointment, the system will automatically trigger an alert advising your team that the client has a stop credit on their account and they have been unable to book an appointment. ezyVet will also generate the same alert if a team member attempts to approve an invoice for the client. Giving your team complete visibility of client debt.

Here's how you can start putting your clinic back in the driving seat and take control of bad debtors

Setting up a Custom Credit Limit

Follow the steps below to create your own custom Credit Limits in ezyVet, that work best for your practice.

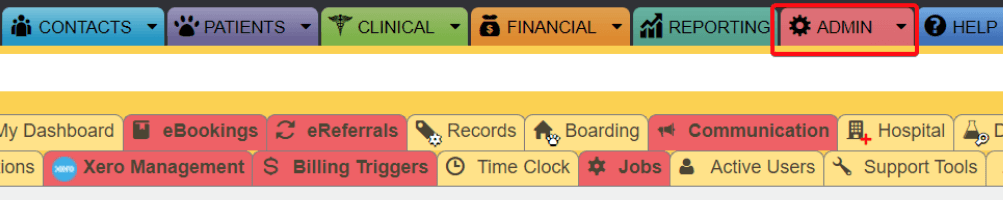

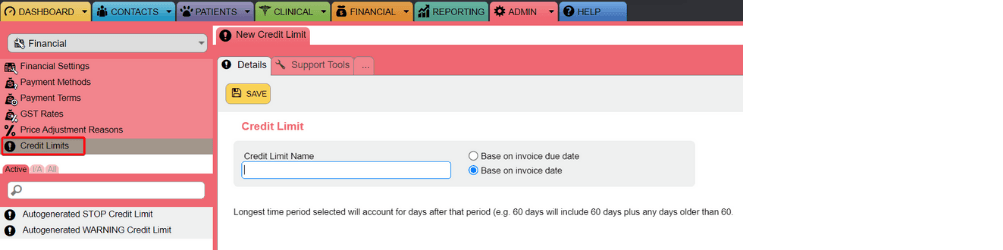

1. Select ADMIN.

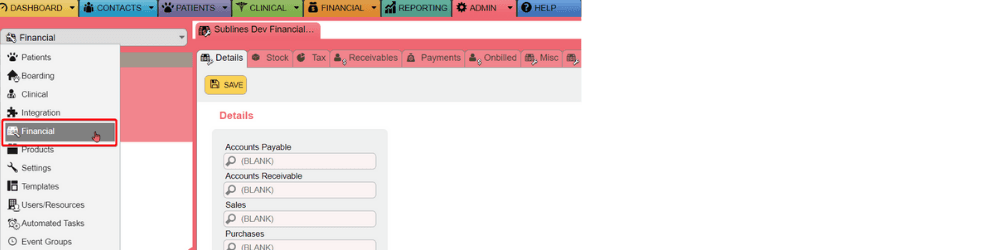

2. Select Financial from the drop-down menu

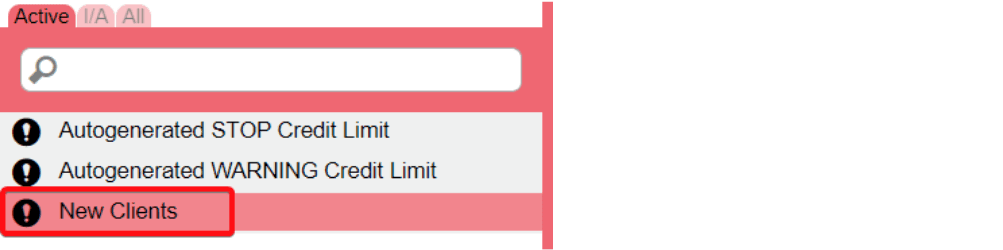

3. Next select Credit Limits - ezyVet automatically comes with two default Credit Limits, you can use these or simply credit your own custom Credit Limit.

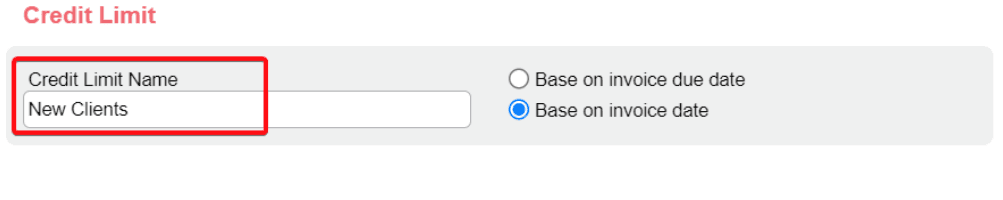

4. In the Credit Limit Name box, pop in the name of your custom Credit Limit.

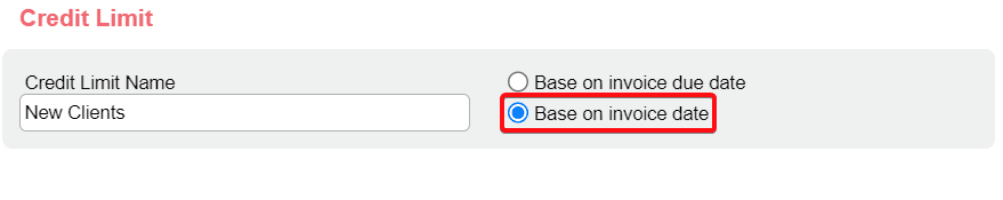

5. Select Base on invoice due date or Base on invoice date.

6. Next press SAVE.

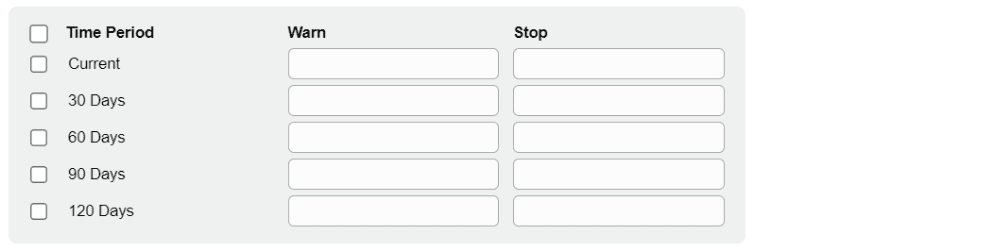

Once you have pressed save, you will be directed to a new table.

Take a look at what each setting means in more detail:

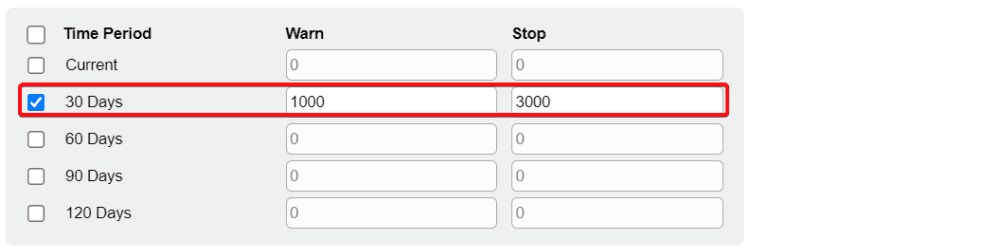

Setting | Description |

Time Period | The Time Period has four related settings. The function of the settings is different if you select Base on invoice due date or Base on invoice date. |

Warn | The credit limit warning in dollar units.

If you enter a Warn value of 0, ezyVet sets the credit limit warning at $0.00. |

Stop | The credit limit in dollar units.

If you enter a Stop value of 0, ezyVet sets the credit limit at $0.00. |

6. Select the applicable time period and enter the applicable Warn and Stop values.

7. And the last step is to press SAVE.

You will now see your newly created custom credit limit appears in the credit limit list.

Now the credit limit has been created you can now apply this to a client's account.

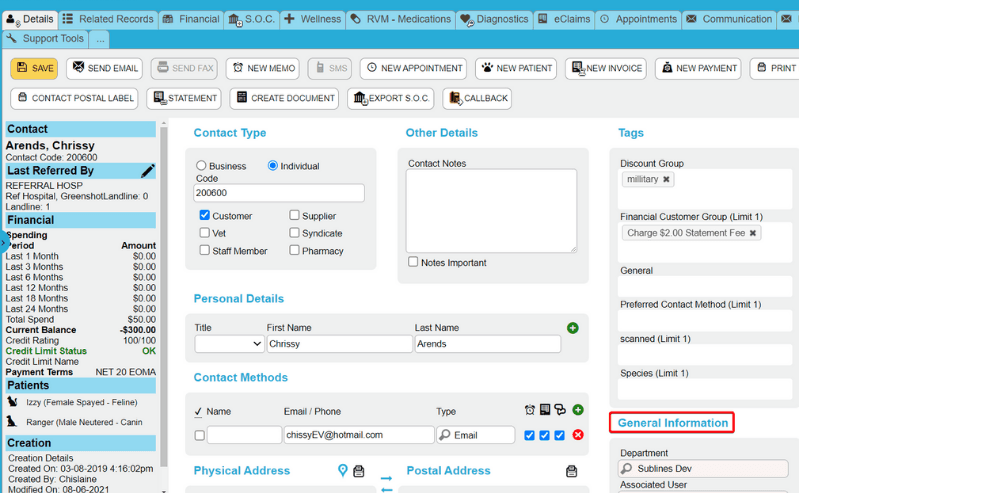

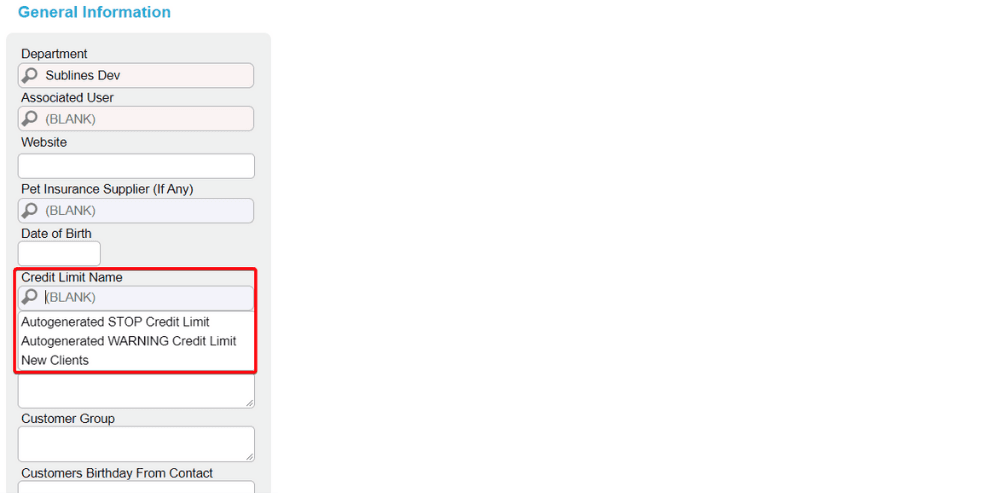

8. Head to the relevant client and then head to the General Information section.

10. In the Credit Limit Name box, select your newly created credit limit.

11. And the last step is to press Save for changes to take affect

Preventative measures stop the problem before it even starts

Taking on a proactive approach, rather than reactive, is the best way to anticipate possible challenges. Preventative measures like Credit Limits give your clinic the freedom to make its own decisions, rather than responding to an issue after it's already got out of hand. Setting up limitations and using automated reminders creates the visibility and certainty for you and your team to tackle any client at the right time and prevents those awkward conversations down the track. The flow-on effect from this initiative is a happy bank balance, a happy team, and more time to focus on what really matters, the patients.

Want to learn more about exciting new features exclusive to Version 30?

Continue reading Demeanors create a safe and stress-free environment